It’s now possible to invest your money for as low as Php50, thanks to GCASH’s GInvest. It’s so easy to start investing your money in GInvest, as long as you have a verified GCASH account.

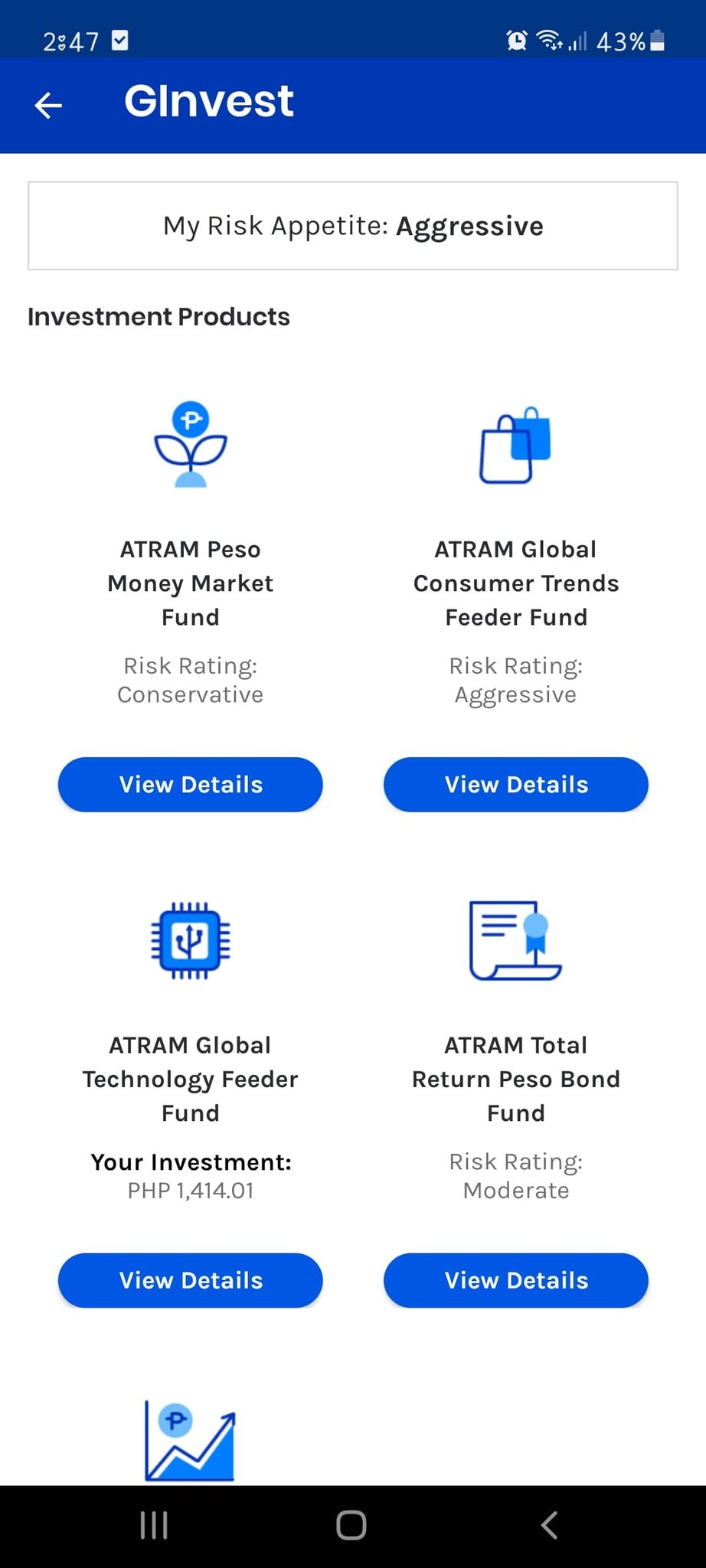

This investment marketplace that you can access using your GCASH app currently offers five investment options for you to choose from:

- ATRAM Peso Money Market Fund

- ATRAM Total Return Peso Bond Fund

- ATRAM Philippine Equity Smart Index Fund

- ATRAM Global Technology Feeder Fund

- ATRAM Global Consumer Trends Feeder Fund

Each fund has different features, minimum initial investments, minimum additional investments, minimum risk type for approval (conservative, moderately aggressive, or aggressive), and fund picks.

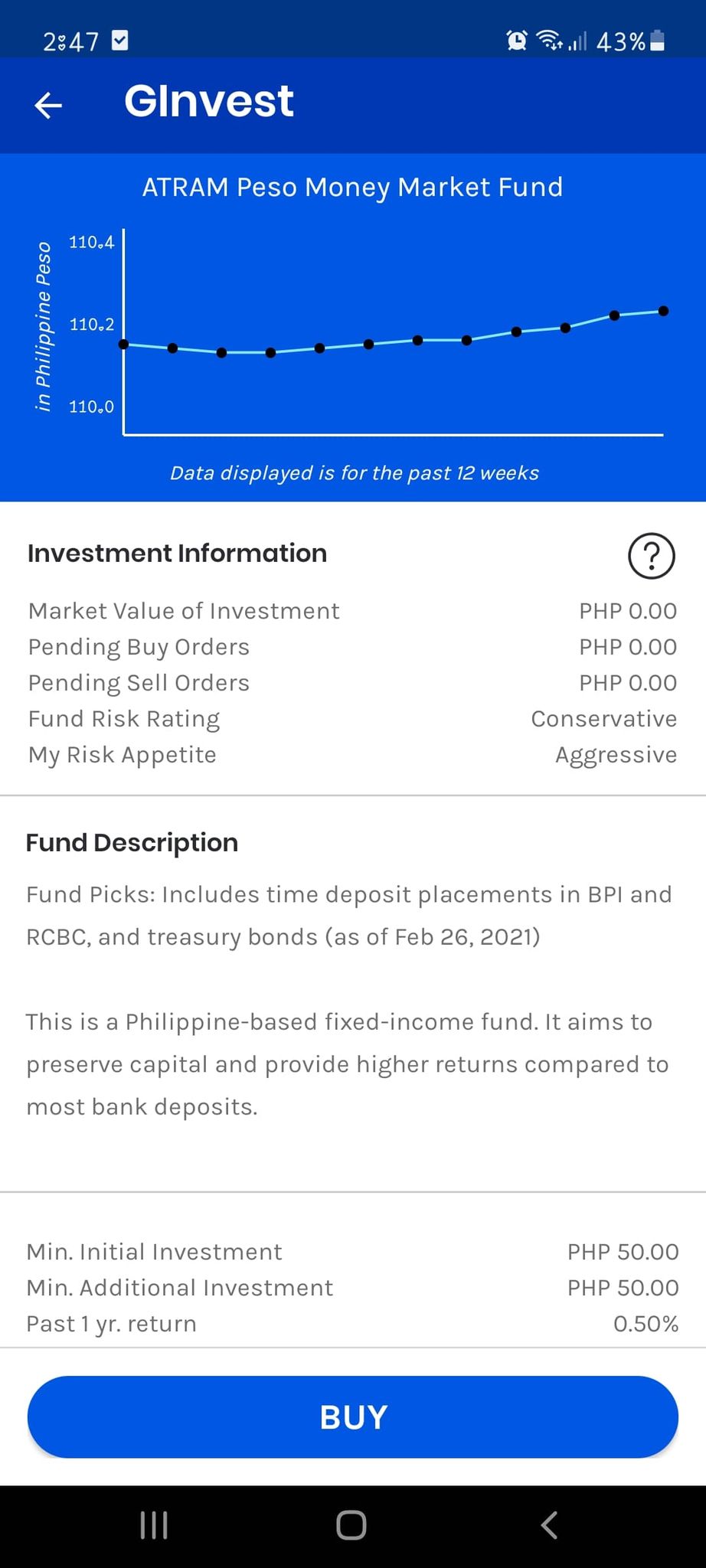

ATRAM Peso Money Market Fund

You can invest in this fund for as low as Php50; it also has a minimum additional investment of Php50.

This fund is available for everyone and is rated as “conservative”. According to the fund description, this is a Philippine-based fixed-income fund that aims to preserve capital while still providing a higher return compared with most bank deposits.

Fund picks are for treasury bonds as well as time deposit placements in BPI and RCBC.

GInvest reports that the fund had a return of 0.50% for the past year.

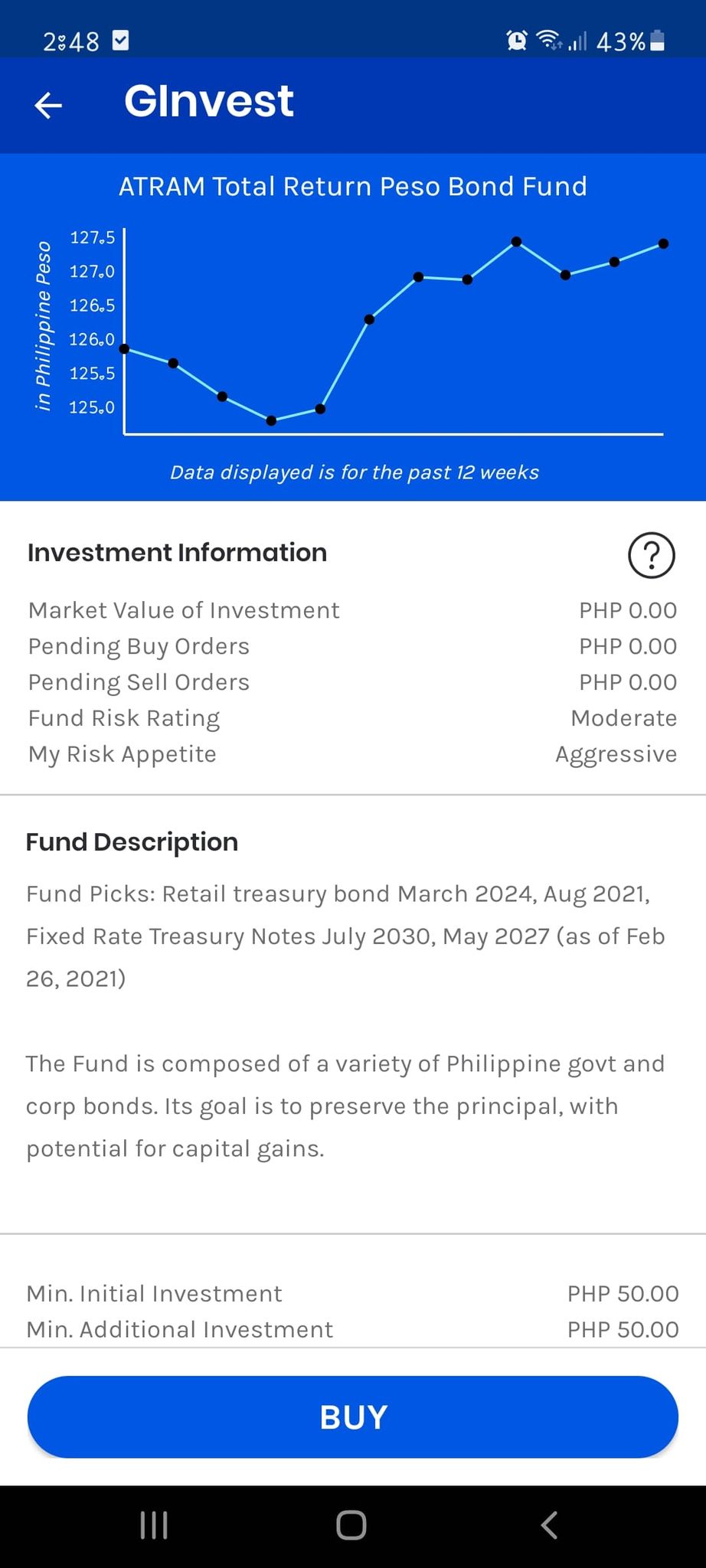

ATRAM Total Return Peso Bond Fund

You can also invest in this fund for as low as Php50; with a minimum additional investment of Php50.

This fund is available for “moderate risk” types and has a goal of preserving the principal, with potential for capital gains through investments in a variety of Philippine government and corporate bonds.

GInvest reports that the fund had a return of 2.81% for the past year.

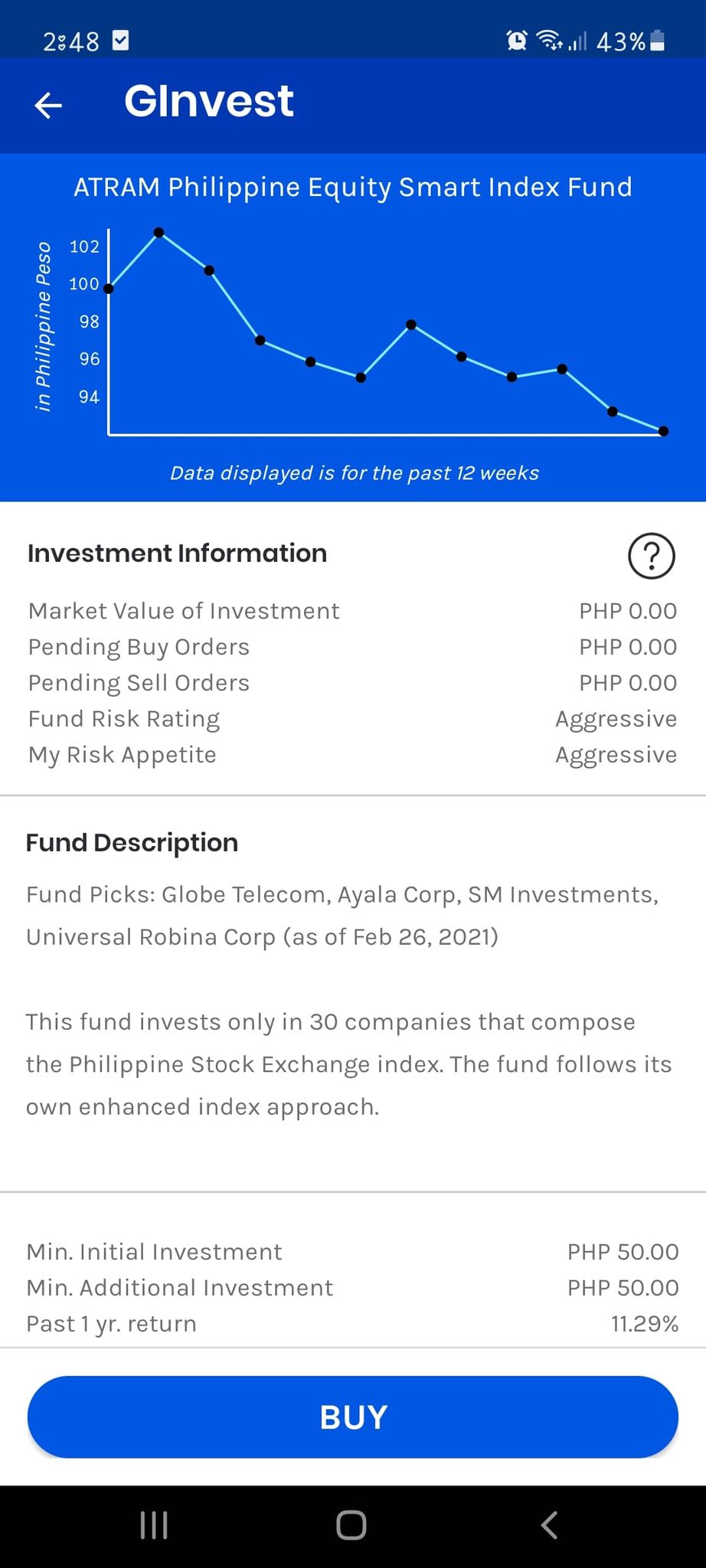

ATRAM Philippine Equity Smart Index Fund

Just like the two other investment options, you can invest in this fund and make additional investments for as low as Php50.

It’s available for investors with an “aggressive” risk type and invests only in 30 companies that compose the Philippine Stock Exchange Index, including Globe Telecom, SM Investments, Ayala Corp, and Universal Robina Corp.

GInvest reports a return of 11.29% for the past year with this fund.

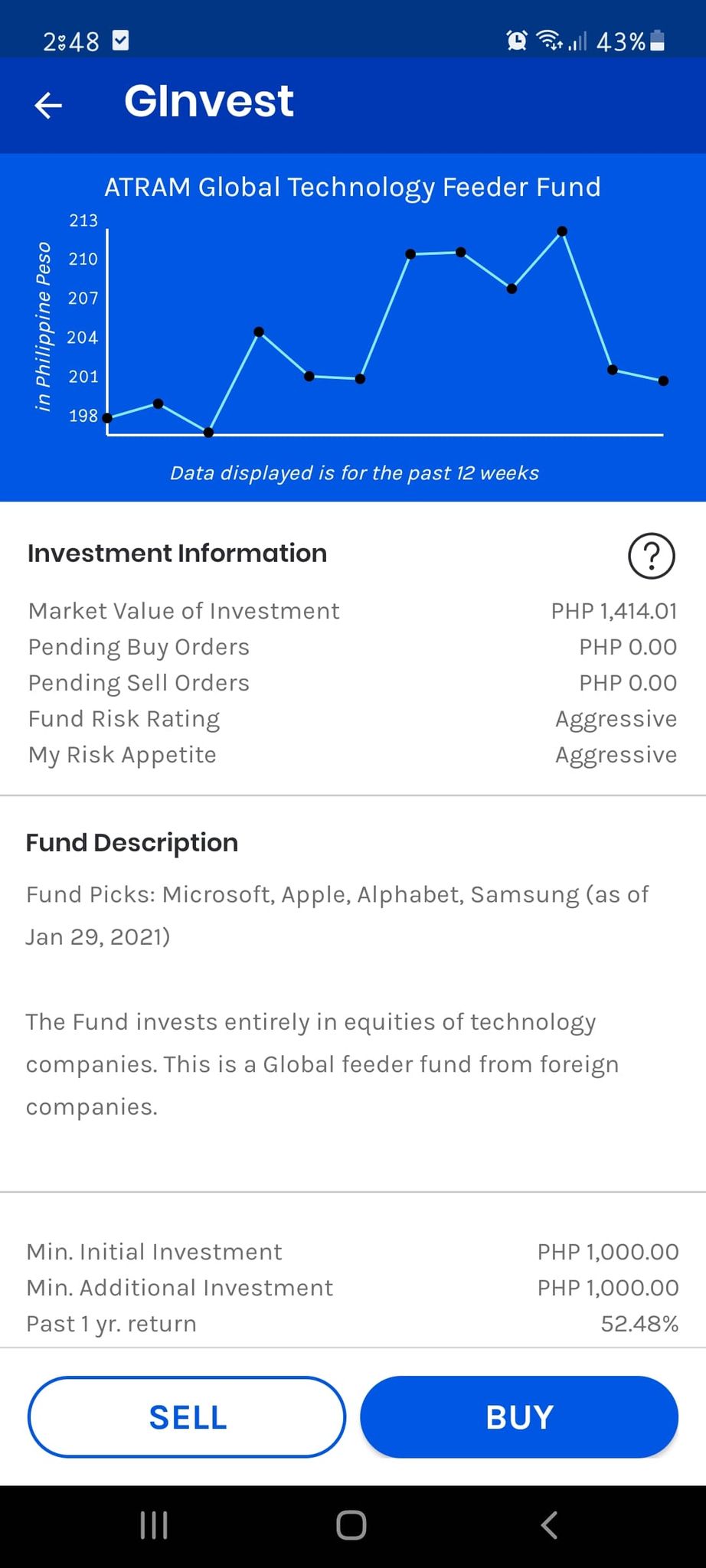

ATRAM Global Technology Feeder Fund

The minimum initial and additional investment is at Php1,000 for this fund.

Available for investors with “aggressive” risk appetite, this fund invests entirely in equities of technology companies across the globe. This global feeder fund picks companies such as Apple, Microsoft, Alphabet, and Samsung.

GInvest reports a return of 52.48% for the past year with this fund.

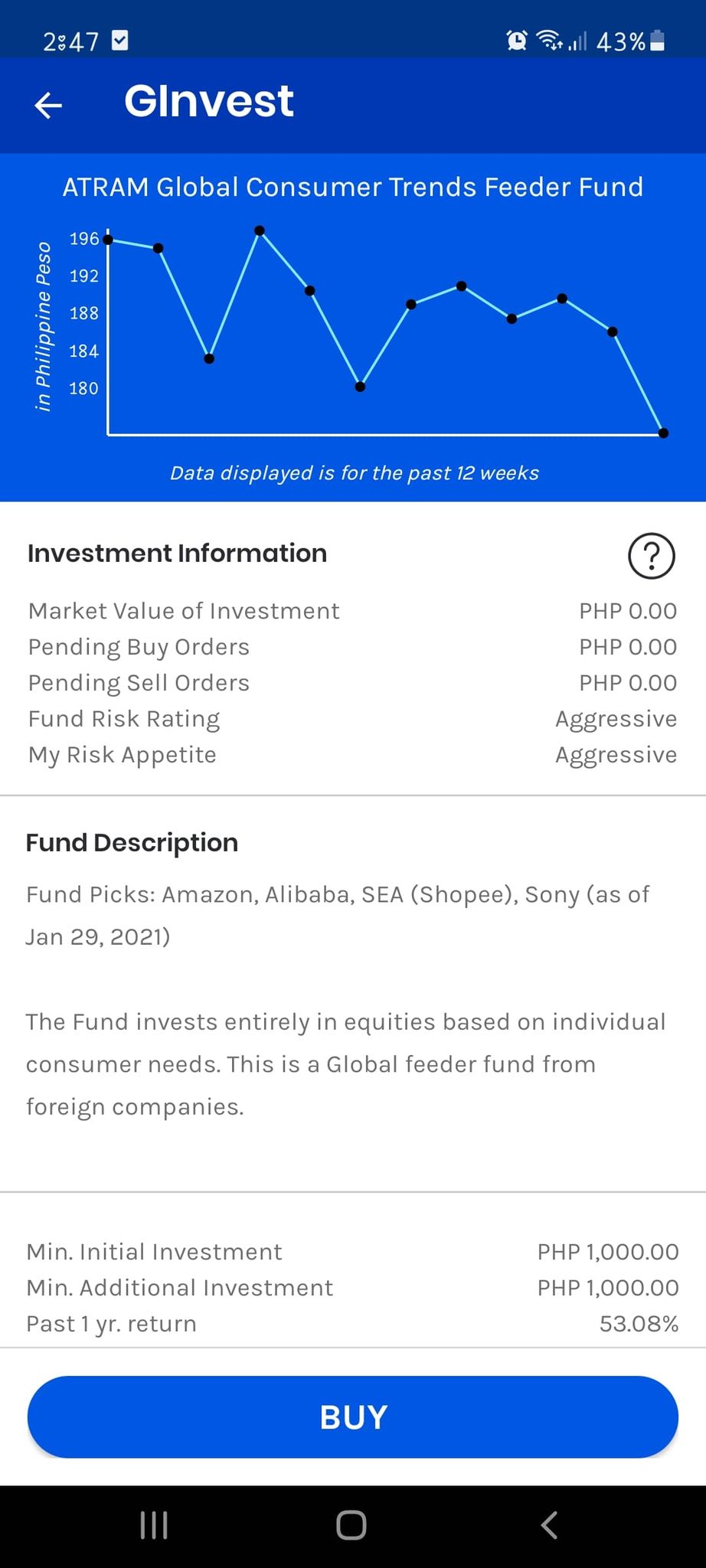

ATRAM Global Consumer Trends Feeder Fund

Just like the global technology feeder, the minimum initial and additional investment for this fund is Php1,000.

It is also available only for investors with a risk appetite of “aggressive” and invests in foreign companies. This fund invests entirely in equities based on individual consumer needs, such as Amazon, Alibaba, SEA (Shopee), and Sony.

GInvest reports a return of 53.08% for the past year with this fund.

Now that you’ve seen all the 5 investment options available with GCASH’s GInvest, have you decided where to invest your money?

Take note: “aggressive” funds could bring you a higher chance of earning more money, but you can also stand to lose more with these types of investments. Meanwhile, “conservative” investments tend to earn much less but there’s a lower risk of losing your investments compared with the “aggressive funds”.

Remember, invest only what you can afford to lose.

- Rosmar Sells Php100 “Pares Overload” With Unlimited Swimming & Outing At Resort - April 23, 2024

- Viral Ice Seller ‘Miss Yelo’ Earns Php90k a Month - March 4, 2024

- Unique ‘Lechon Manok’ Cooked in a Clay Pot Goes Viral - February 29, 2024