Most Filipinos are members of the Pagtutulungan: Ikaw, Bayan, Industriya, at Gobyerno, or what is more commonly known as Pag-IBIG Fund. Each member’s monthly contribution of P100 is used to finance members’ housing loans and other short-term loans such as their Multi-Purpose and Calamity Loans.

Aside from the usual contributory membership program, the Pag-IBIG Fund also offers its member with another savings option that yields higher dividend rates. Moreover, this is what is called the Modified Pag-IBIG II, or MP2, Program.

Save and earn

A minimum monthly contribution of P500 for 60 months or five years under the MP2 Program is guaranteed to earn a minimum dividend rate of four percent yearly. Contribution for the MP2 Program is different and separate from the mandatory P100 contribution deducted from an employee’s monthly salary.

Photo Credits: Pag-IBIG

There is no limit on the amount of money a member can save under the MP2 Program. He or she can regularly save P500 monthly or opt for one-time savings.

Pag-IBIG MP2 Saving may be paid through salary deduction, for employed members; over-the-counter, in any Pag-IBIG branch, and through any accredited collection partners.

Savings in the amount exceeding P500,000 would have to be remitted personally or through a manager’s check.

Earn through dividends

Dividends for the MP2 Program are derived from no less than 70 percent of the Pag-IBIG Fund’s annual net income.

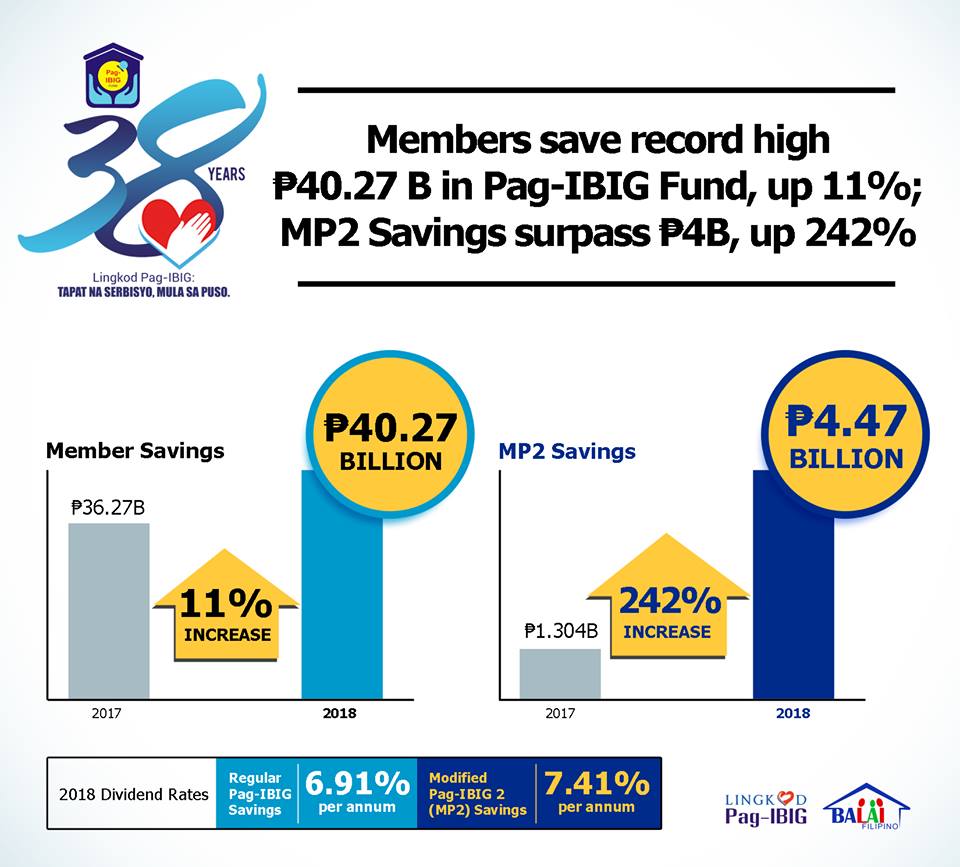

In 2015, the MP2 dividend rate rose to 5.34 percent, climbed steadily to 7.43 percent in 2016 and continuously increased to 8.11 percent in 2017.

These rates are higher than the average 2.98 percent interest rate offered by commercial banks for its time deposit accounts in 2017, based on data from Bangko Sentral ng Pilipinas.

In 2018, the dividend rate for MP2 was at 7.41 percent.

Photo Credits: The Facebook Account of Pag-IBIG Fund

Earnings and contributions under the MP2 Program are tax-free and government-guaranteed.

A member has an option for an annual dividend payout which will be credited to his or her savings or checking account with Land Bank of the Philippines, Development Bank of the Philippines, or other banks that Pag-IBIG Fund may accredit. On the other hand, he or she can choose to receive the MP2 compounded dividends upon the maturity of his or her savings after five years.

How to be a member

Eligible to save under the MP2 Program are the active Pag-IBIG Fund members and former Pag-IBIG Fund members with a source of monthly income. Pensioners or retirees who have previously contributed at least 24 monthly savings are also eligible to invest under the MP2 Program.

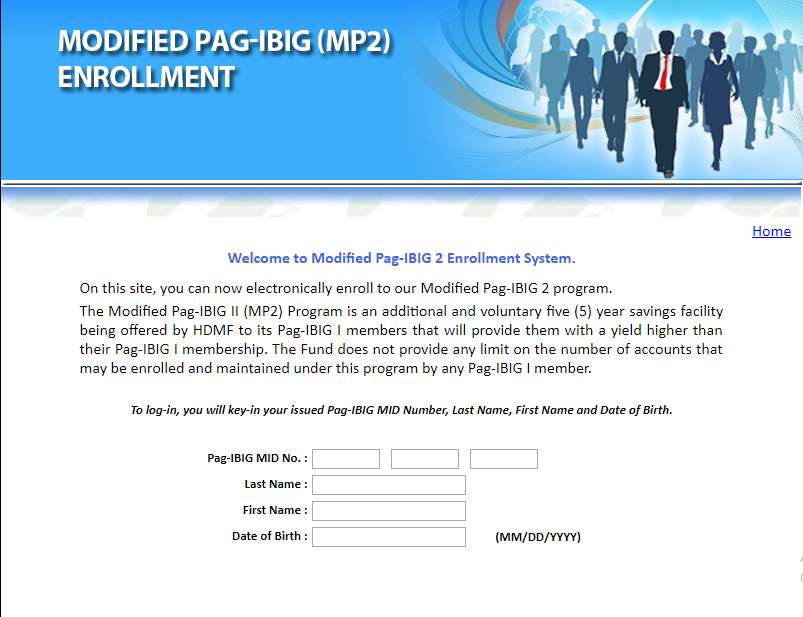

Interested Pag-IBIG Fund members may register online at https://www.pagibigfundservices.com/MP2Enrollment/.

- Due to Unfair Practices, SEC Bars Lending Firm’s Operation - December 30, 2020

- Motorists Can Use Partially Open Skyway 3, Free for a Month - December 28, 2020

- Monthly Contributions to the SSS’s Mandatory Provident Fund Starts in January 2021 - December 26, 2020