While the country continuously battles the pandemic, several banks have agreed to extend the waiver on fund transfer fees in a bid to help the economy recover.

Bangko Sentral ng Pilipinas (BSP) Governor Benjamin E. Diokno said that the initiative is part of the banking sector’s response to the call for relief measures that will benefit the general public.

At the same time, he added, that this move is in line with the BSP’s effort to promote the use of digital payments as part of a safe and convenient payment system and its vision of transforming half of all financial transactions to cashless by mid-2023.

Image: Facebook/Bangko Sentral ng Pilipinas

Member-banks of the Philippine Payments Management, Inc. such as Union Bank of the Philippines, Asia United Bank, Land Bank of the Philippines, Security Bank, Sterling Bank, Standard Chartered Bank, and HSBC have all agreed to waive transfer fund fees through PESONet and InstaPay until the end of December 2020.

Meanwhile, other banks such as BDO Unibank, Metropolitan Bank and Trust Co., Bank of the Philippine Islands, Rizal Commercial Banking Corp., Bank of Commerce, Robinsons Bank, Philippine Savings Bank, China Bank, China Bank Savings, as well as PayMaya and GCash will extend the waiver until September 30, 2020.

Image: Facebook/Bangko Sentral ng Pilipinas

On the other hand, the Philippine National Bank will extend its waiver until further notice. At the same time, HSBC has also implemented reduced fees for corporate clients—from P150 to P50 per transaction—since July 1.

The National Retail Payment System (NRPS)

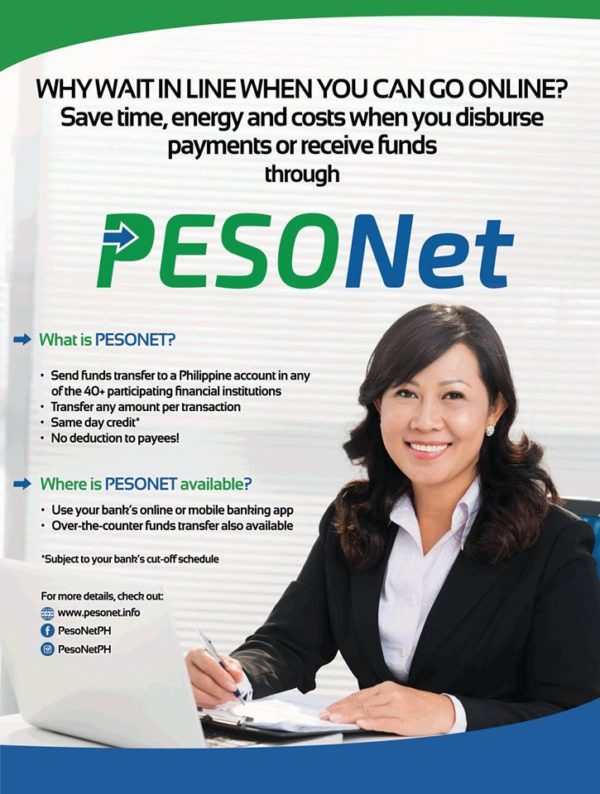

There are two electronic payment systems under NRPS—InstaPay and PESONet.

Recording about 8.86 million transactions last April, Instapay enables the client to transfer up to P50,000 per transaction. On the other hand, there are about 1.08 million transactions through PESONet, a credit payment scheme for business-to-business and people-to-business transactions.

“It was observed that the volume and value of the combined transaction of PESONet and InstaPay during the ECQ period surged, while the volume and value of check payments and ATM withdrawals declined,” says Diokno.

- Due to Unfair Practices, SEC Bars Lending Firm’s Operation - December 30, 2020

- Motorists Can Use Partially Open Skyway 3, Free for a Month - December 28, 2020

- Monthly Contributions to the SSS’s Mandatory Provident Fund Starts in January 2021 - December 26, 2020