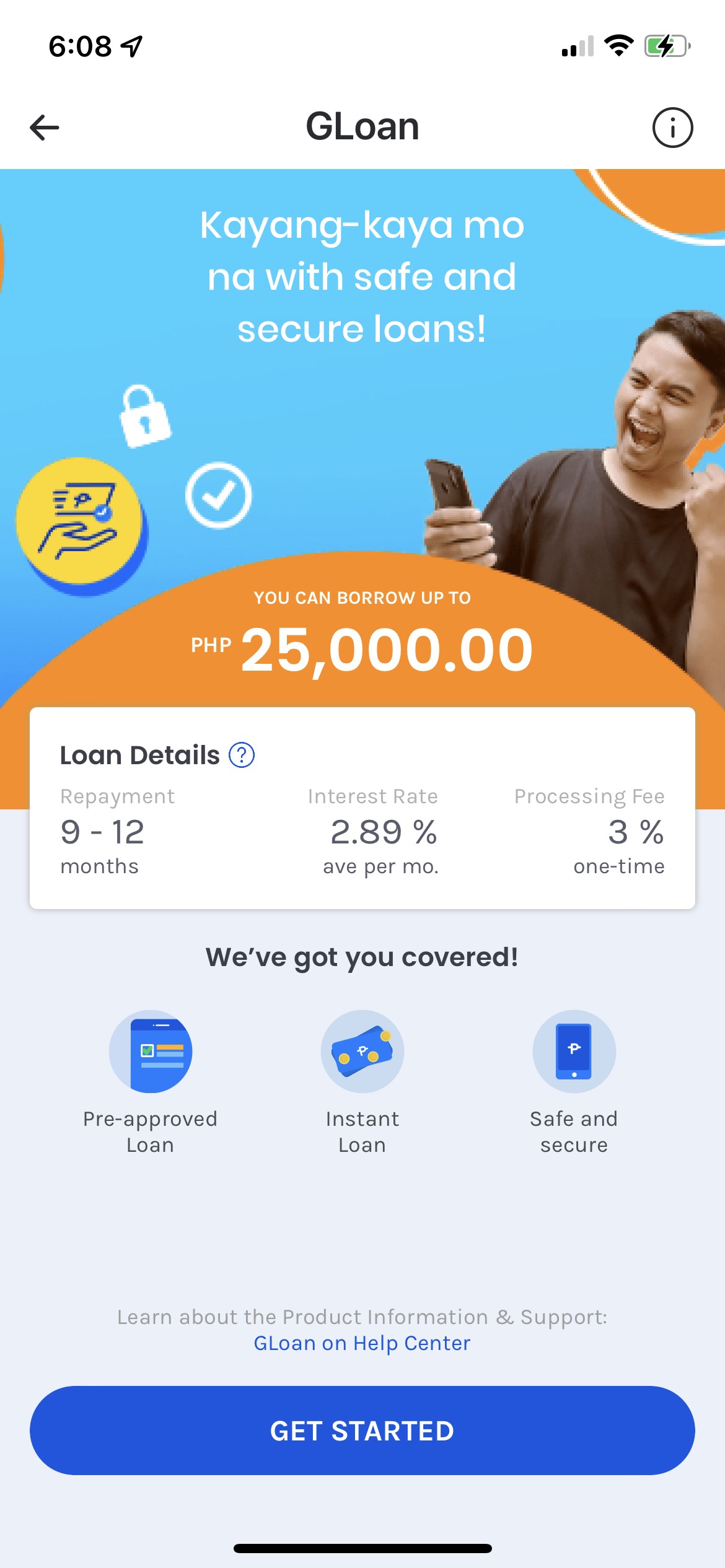

GCASH offers loan options for up to Php25,000, with flexible terms up and payable for up to 12 months. It’s available for an interest rate of 2.59% to 2.89% (depending on the loan amount) and has a processing fee of 3%, but it can be a convenient way to get some quick cash.

GCASH Offers Loan: How to Apply

The service isn’t available for everyone, but if you’re eligible, you can easily apply for a loan. You can pick the amount you want.

GLoan is transparent in how much fees you’ll pay, including the charges deducted from the loan proceeds.

GCASH offers loan options. Here’s how you can apply:

Step 1. Open the app and find the GLoan icon from your GCASH dashboard. If it doesn’t appear on the main screen, click “View All GCASH Services.”

GLoan is under “Financial Services”, between “GInvest” and “GGives.”

Step 2. If you’re eligible, the app will allow you to easily process the loan with a few taps on the screen.

Step 3. Click “Get Started.”

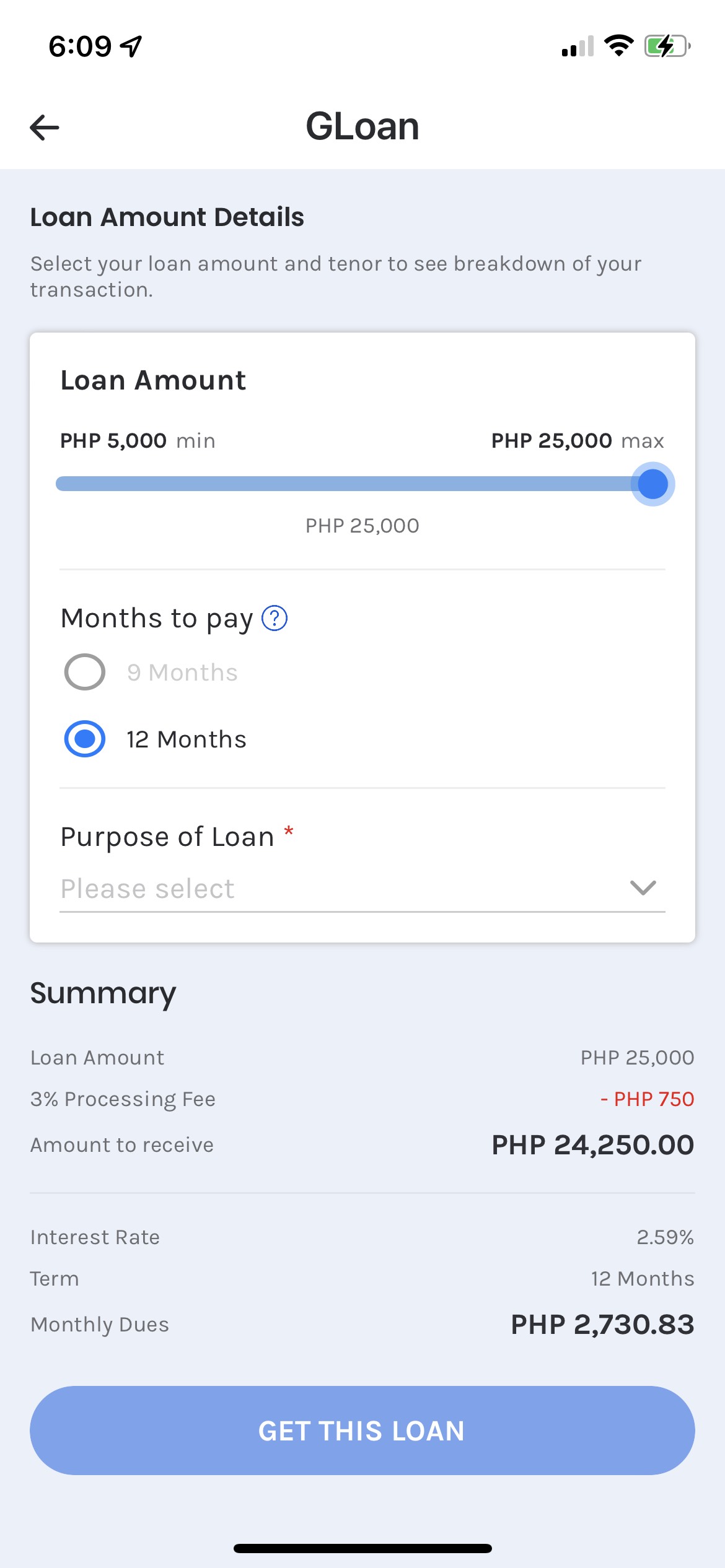

Step 4. Choose the amount you want to borrow. Note that the payment terms, processing fees, and monthly dues will vary depending on loan amount.

- Loans up to Php15,000 are payable within 9 months and have an interest rate of 2.89%.

- Loans from Php16,000 to the maximum Php25,000 are payable in 12 months and have an interest rate of 2.59%.

Here are some sample computations:

- A Php5,000 loan only has a Php150 processing fee and is payable in 9 months. You need to pay a monthly amortization of Php700.06.

- A Php15,000 loan has a Php450 processing fee and is payable in 9 months. The monthly amortization is Php2,100.17.

- A Php16,000 loan has a Php480 processing fee and is payable in 12 months. The monthly amortization is Php1,747.73.

- A Php25,000 loan has a processing fee of Php750 and is payable in 12 months. The monthly amortization is Php2,730.83.

Currently, you can change the payment terms, but you have the option to choose the amount you wish to loan.

Step 5. Choose the “Purpose of Loan” from the drop down list.

Step 6. Click “Get This Loan.”

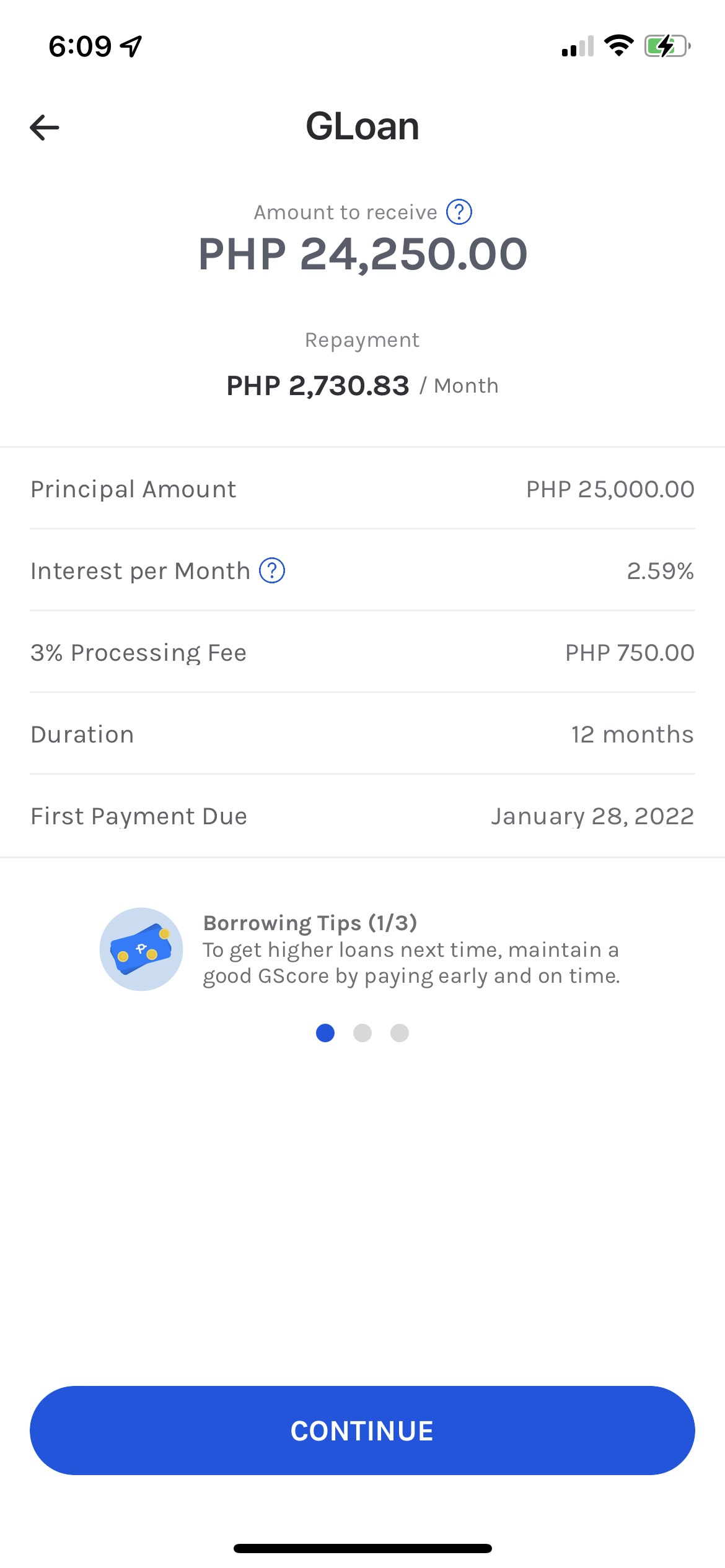

Step 7. Review your loan from the summary. You can also find your loan’s first due date on the summary. Click “Continue” if you’re satisfied with this calculation or go back to choose another option.

Step 8. Review your personal information (pre-filled out). Click “Next.”

Step 9. Fill out all the required data to continue with your application. Again, click “Next.”

Step 10. Click the box beside the “Data Privacy Agreement.”

Step 11. Review the loan terms again. Then click the boxes under “Loan Agreements.”

Step 12. Confirm your loan disbursement amount.

Step 13. A code will be sent to your registered mobile number. Enter this code to confirm your loan.

Step 14. You’ll receive another text message to confirm your successful application, with the corresponding reference number.

Step 15. Wait for your loan proceeds to be credited to your GCASH account.

- Viral Ice Seller ‘Miss Yelo’ Earns Php90k a Month - March 4, 2024

- Unique ‘Lechon Manok’ Cooked in a Clay Pot Goes Viral - February 29, 2024

- Carinderia in Tondo Goes Viral for Delicious Food, Inspiring Owners - February 17, 2024