The Development Bank of the Philippines (DBP) implements a special financing program specifically developed for women-owned and managed enterprises for the establishment of viable income-generating activities. The Inclusive Lending for Aspiring Women Entrepreneurs, or ILAW, offers competitive rates and flexible terms for women to start a business.

The ILAW program aims to support women empowerment through entrepreneurship and help small businesses grow beyond microcredit. Furthermore, the DBP helps create jobs and build local economies through this program.

Most importantly, the program intends to mobilize women organizations towards promoting the growth of women entrepreneurs.

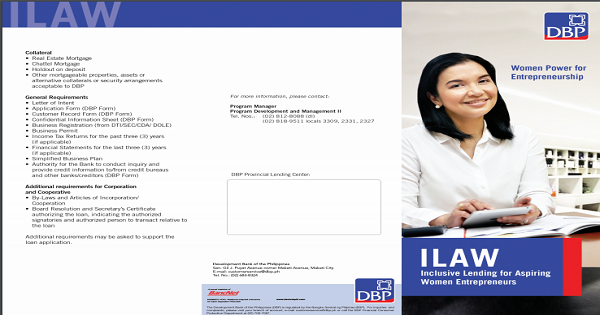

Photo credit: DBP

As compared to other financial assistance programs, ILAW boasts of simplified lending procedures and requirements for micro and small business loans; dedicated financing window; flexible collateral policy; and customized repayment schedules to match business cash flow.

Qualified to borrow from the program are the single proprietorship business with a woman, as the principal; a business partnership with at least one woman partner; a corporation with a woman CEO or COO; a cooperative where majority of the members are women; and other business entities with legal personality to engage in a business enterprise with asset size of P100 million and below where women play a major role.

Program beneficiaries may borrow up to 90 percent of the total project cost and with a minimum amount of P300,000.

Photo credit: DBP

Requirements

To apply for a loan from the ILAW program, applicants must submit the following to the DBP:

- Letter of Intent;

- Application Form from DBP;

- Customer Record Form from DBP;

- Confidential Information Sheet;

- Business Registration Form from DTI/SEC/CDA/DOLE;

- Business Permit;

- Income Tax Returns for the past three years, if applicable;

- Financial Statements for the last three years, if applicable;

- Simplified Business Plan; and

- Authority for the Bank to conduct inquiry and provide credit information to/from credit bureaus and other banks/creditors

There are additional requirements for Corporation- and Cooperative-applicants;

- By-Laws and Articles of Incorporation; and

- Board Resolution and Secretary’s Certificate authorizing the loan, indicating the authorized signatories and authorized person to transact in connection to the loan.

For more information about the DBP’s ILAW program, please visit the DBP’s website, www.dbp.ph

- Due to Unfair Practices, SEC Bars Lending Firm’s Operation - December 30, 2020

- Motorists Can Use Partially Open Skyway 3, Free for a Month - December 28, 2020

- Monthly Contributions to the SSS’s Mandatory Provident Fund Starts in January 2021 - December 26, 2020