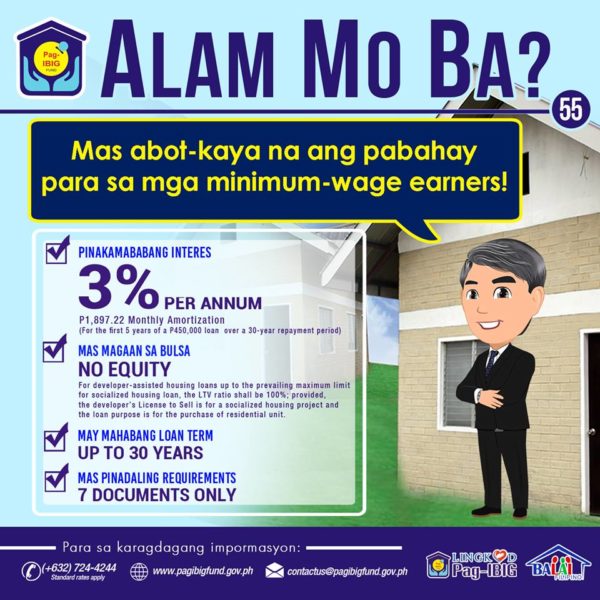

A minimum wage earner has an opportunity to acquire his or her own house and lot, thanks to Pag-IBIG’s Affordable Housing Program (AHP).

The said program allows an active Pag-IBIG member to apply for and be granted with a housing loan with an interest rate of only three percent for the first five years of a 30-year loan term.

For example, for a loan amount of P450,000 payable for 30 years, the borrower will only pay P1,897 per month for the first five years.

AHP loans may finance any one or a combination of the following:

- Purchase of a fully-developed residential lot or adjoining residential lots not exceeding 1,000 square meters;

- Purchase of a residential house and lot, townhouse, or condominium unit, which may be pre-owned; mortgaged with Pag-IBIG; or adjoining apartments and lot, row houses, or condominium units;

- Construction or completion of a residential unit on a residential lot owned by the borrower or his or her relative;

- Home improvements; and

- Refinancing of an existing housing loan provided that the member must not incur late payments for the last six months from the date of application.

Photo credits: The Facebook Page of Pag-IBIG

Borrower’s eligibility

All active Pag-IBIG members, including overseas Filipino workers, who have a gross monthly income not exceeding P17,500 are eligible to apply for a loan under the AHP, provided that the member has already made at least 24 monthly savings. If his or her Pag-IBIG savings is less than 24, he or she can pay the equivalent amount in lump sum.

The member must not be more than 65 years old, and not more than 70 years old at maturity of the date of loan application.

Moreover, the borrower must have the legal capacity to acquire and encumber real property and must be able to satisfactorily pass the Pag-IBIG Fund’s background, credit, employment, or business checks.

Furthermore, he or she must have no outstanding short-term loan in arrears with Pag-IBIG Fund, at the time of loan application. Likewise, he or she should have no Pag-IBIG Fund housing loan that was foreclosed, canceled, or bought back due to default.

Lastly, a borrower must update any existing housing account under the Pag-IBIG Fund so that he or she may be granted with another loan under AHP.

Loan Amount and Loan Terms

The amount of loan which may be granted to the borrower is the lowest among the following;

- member’s desired loan amount,

- his loan entitlement based on gross monthly income and capacity to pay;

- loan-to-appraised value ratio.

The maximum amount that a member may borrow under the AHP is P750,000. Loans are payable for a maximum period of 30 years.

Photo credits: Pag-IBIG Fund

The application forms and a checklist of requirements are downloadable at Pag-IBIG’s website, www.pagibigfund.gov.ph.

To schedule an appointment to submit a housing loan application and requirements, a member may log-on at www.pagibigfund.gov/housing loan. Those who booked an appointment online is given priority over walk-in applicants and will be assisted through a particular lane in the Pag-IBIG branch office.

Members may also personally apply for a loan by proceeding to the Pag-IBIG Fund’s Servicing Department or at any Pag-IBIG Fund branch office.

- Due to Unfair Practices, SEC Bars Lending Firm’s Operation - December 30, 2020

- Motorists Can Use Partially Open Skyway 3, Free for a Month - December 28, 2020

- Monthly Contributions to the SSS’s Mandatory Provident Fund Starts in January 2021 - December 26, 2020