There are lots of safe investment opportunities for OFWs (Overseas Filipino Workers). One of these is through Pag-IBIG MP2, a program by the Home Development Mutual Fund (HDMF), more popularly known in the Philippines as Pag-IBIG.

Advantages of Investing in Pag-IBIG MP2

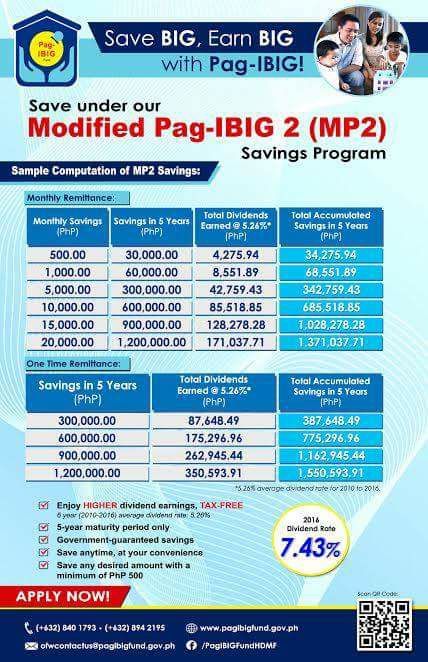

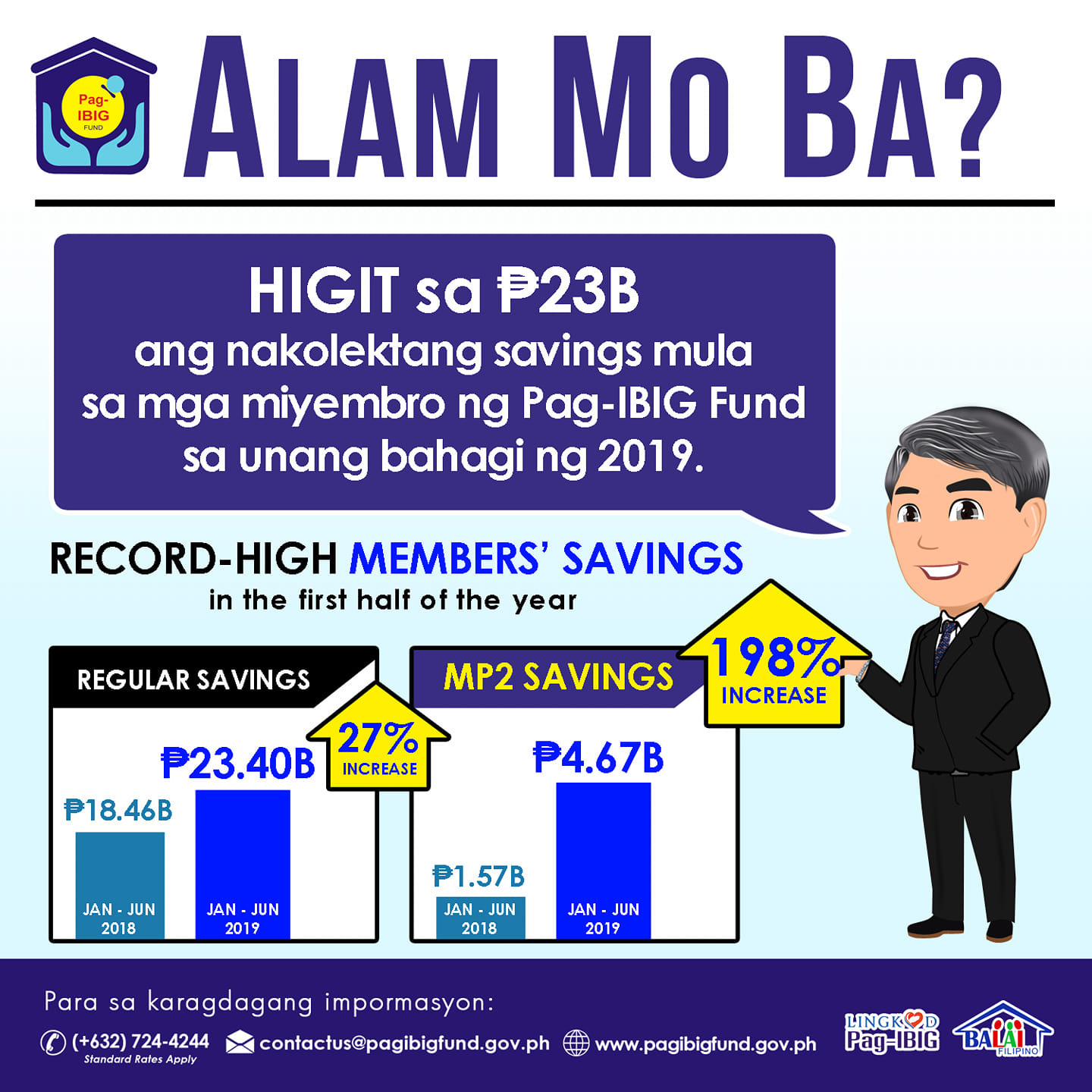

Unlike the mandatory contributions, Modified Pag-IBIG 2 (MP2) is not required. But this voluntary savings program is available for those who have extra cash and wish to invest in something that is tax free, offers higher interest rates than those offered by banks, and is guaranteed by the government.

Thus, the MP2 savings program is perfect for OFWs.

While the interest rate is not fixed, this is expected to be much higher than those offered by banks. Dividend rates rose from 4.63% in 2011 to as high as 8.11% in 2017. The rate has gone down to less than 8% for the next years but still higher than 7%.

There are also two options on how you can get your dividends for the MP2 savings program. It is possible to enjoy annual payout of dividends credited to Pag-IBIG Fund accredited banks or through checks. The other option is to simply let your money grow and later receive the full dividend, compounded annually, at the end of the 5-year maturity period.

What’s great about Pag-IBIG MP2 is that there is actually no limit to the money you can save through the program. However, if you plan on investing more than Php500,000, you have to issue a personal or manager’s check.

Moreover, you can opt to open and maintain multiple savings accounts through the MP2.

Once the 5-year term ends, your savings will continue to earn dividends for 2 more years. Afterwards, the fund remains dormant and will no longer earn dividends. However, you can always opt to reinvest it by transferring the funds to a new MP2 account.

So, where does Pag-IBIG invest the money? A lot of people are curious as to how their money can grow. The good news is that this investment is used to help others through the housing loan program. At least 70% of Pag-IBIG Fund’s investible funds goes to housing finance. The rest are used for corporate bonds and government securities.

How to Invest in Pag-IBIG MP2

To invest, you can follow these steps:

- Register as Pag-IBIG member. Take note that although this is not a mandatory savings program, MP2 is only open for existing Pag-IBIG members. So, make sure you are one.

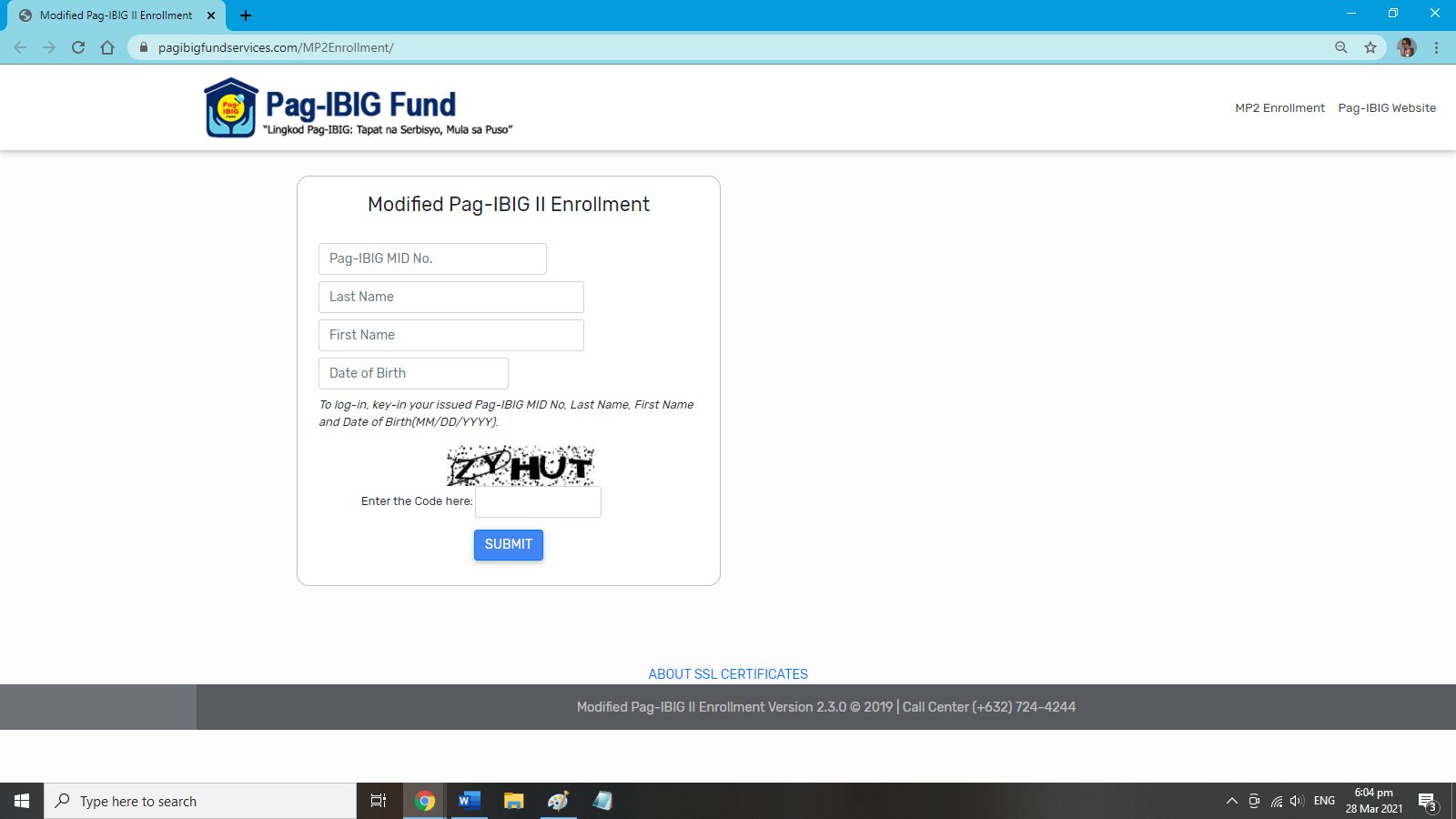

- Enroll for the MP2 program. There are two ways to do this. You can either enroll at the nearest Pag-IBIG office or do so online via this link: https://www.pagibigfundservices.com/MP2Enrollment/Default.aspx.

- Choose the mode of payment. Modes of payment include salary deduction, over the counter (OTC), thru any accredited Pag-IBIG collecting partners, or via the online payment platform on the Virtual Pag-IBIG site.

- Once enrollment is successful, make sure to pay the amount you plan to invest per month. The minimum monthly contribution is Php500 for a 5-year term.

So, if you are an OFW looking for a safe, convenience, and secure investment option, then you can open a savings account through this Pag-IBIG MP2 program.

- Rosmar Sells Php100 “Pares Overload” With Unlimited Swimming & Outing At Resort - April 23, 2024

- Viral Ice Seller ‘Miss Yelo’ Earns Php90k a Month - March 4, 2024

- Unique ‘Lechon Manok’ Cooked in a Clay Pot Goes Viral - February 29, 2024