Did you know that it’s easy to get a loan from SSS if you’re a self-employed or voluntary member? It even takes less than a week for the loan to get approved and credited to your bank account!

SSS Loan Eligibility

The SSS offers several loan options, but we take up a salary loan in this article.

For salary loans, there are two types:

- One-month loan

- Two-month loan

These loans are granted, depending on the monthly salary credit (MSC) that you’ve been paying for. So, even if you have a big salary, example Php50,000, but only contributing an MSC worth Php10,000, then you will only be eligible for a loan worth Php10,000 (one-month loan) or Php20,000 (two-month loan).

SSS members are eligible for a loan, as long as they meet the minimum criteria:

For a one-month salary loan, at least 36 posted monthly contributions, with at least 6 within the last 12-month period before the loan.

For a two-month salary loan, at least 72 posted monthly contributions, with at least 6 within the last 12-month period before the loan.

The final loan amount will depend on your average MSC, depending on whether you were able to pay all the contributions for 12 months or just 6 months.

How to Apply for SSS Loan Online

It’s easy for self-employed or voluntary members to apply for an SSS loan online. Just follow these steps:

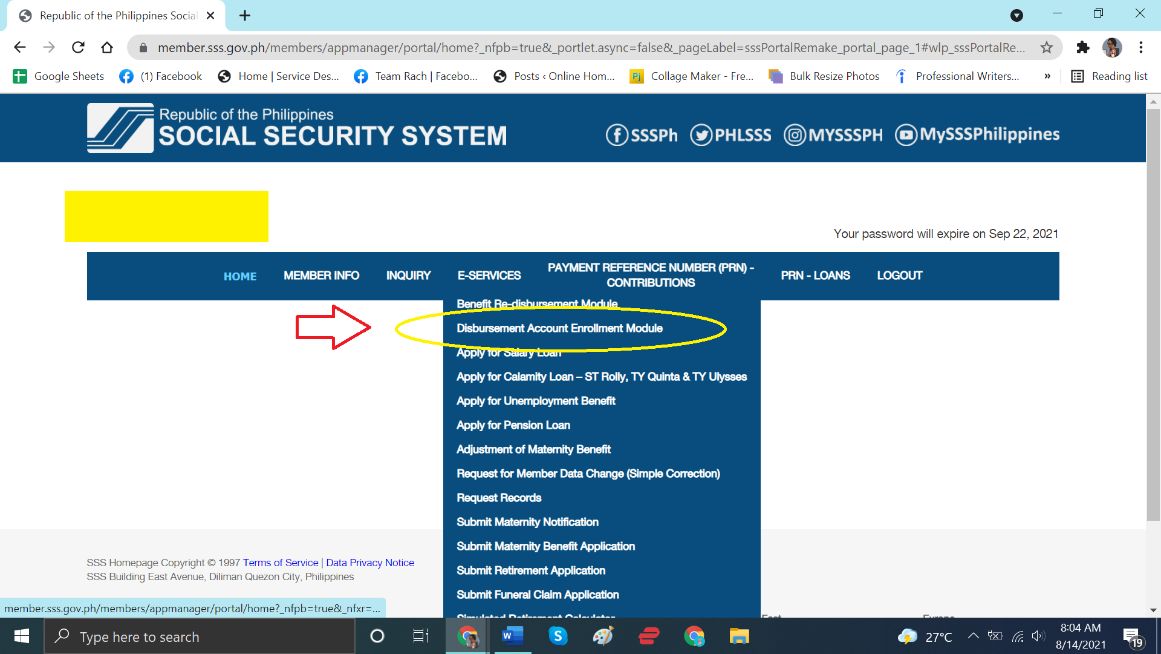

Step 1. First, enroll your bank account using the “Disbursement Account Enrollment Module.”

Note that the account you’re enrolling shouldn’t be:

- Closed account

- Dormant account

- Owned by someone else

- Joint account

- Time deposit account

- Dollar account

- Prepaid account

- Account with restrictions

- Frozen account

Make sure to input the correct details, only use your own account, and input your correct mobile number.

You also have to upload a proof that the account is yours. This can be done by taking a photo of the front part of your ATM.

Step 2. SSS will process your submitted documents, but it usually takes just a few days for the disbursement account to be verified.

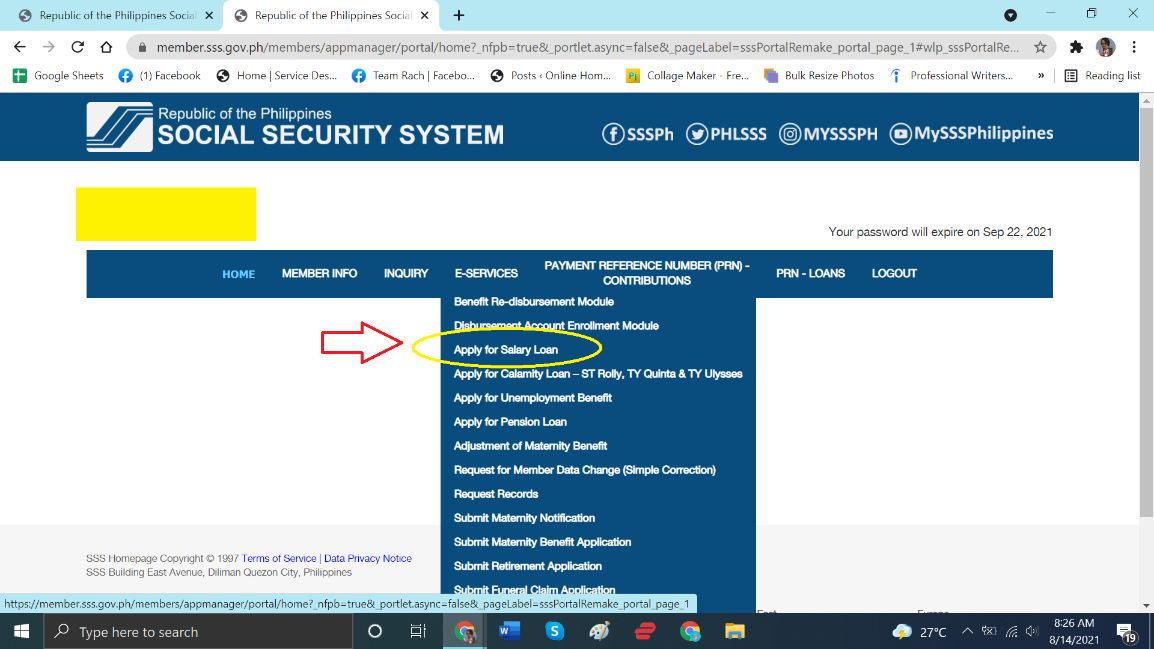

Step 3. Click “Apply for Salary Loan.”

The system will automatically calculate how much loan you’re eligible for, including when you’ll start paying, how much you’ll pay monthly, and for how long you’ll need to pay the loan.

If you agree with the terms, proceed with the loan.

Step 4. SSS will send you a message once the loan is approved. It takes just around 2 days to receive the proceeds in your enrolled disbursement account.

- Viral Ice Seller ‘Miss Yelo’ Earns Php90k a Month - March 4, 2024

- Unique ‘Lechon Manok’ Cooked in a Clay Pot Goes Viral - February 29, 2024

- Carinderia in Tondo Goes Viral for Delicious Food, Inspiring Owners - February 17, 2024