Inflation has been one of the most discussed and publicized issues this year. We often hear it on the news, but do we really understand how it impacts our day-to-day lives?

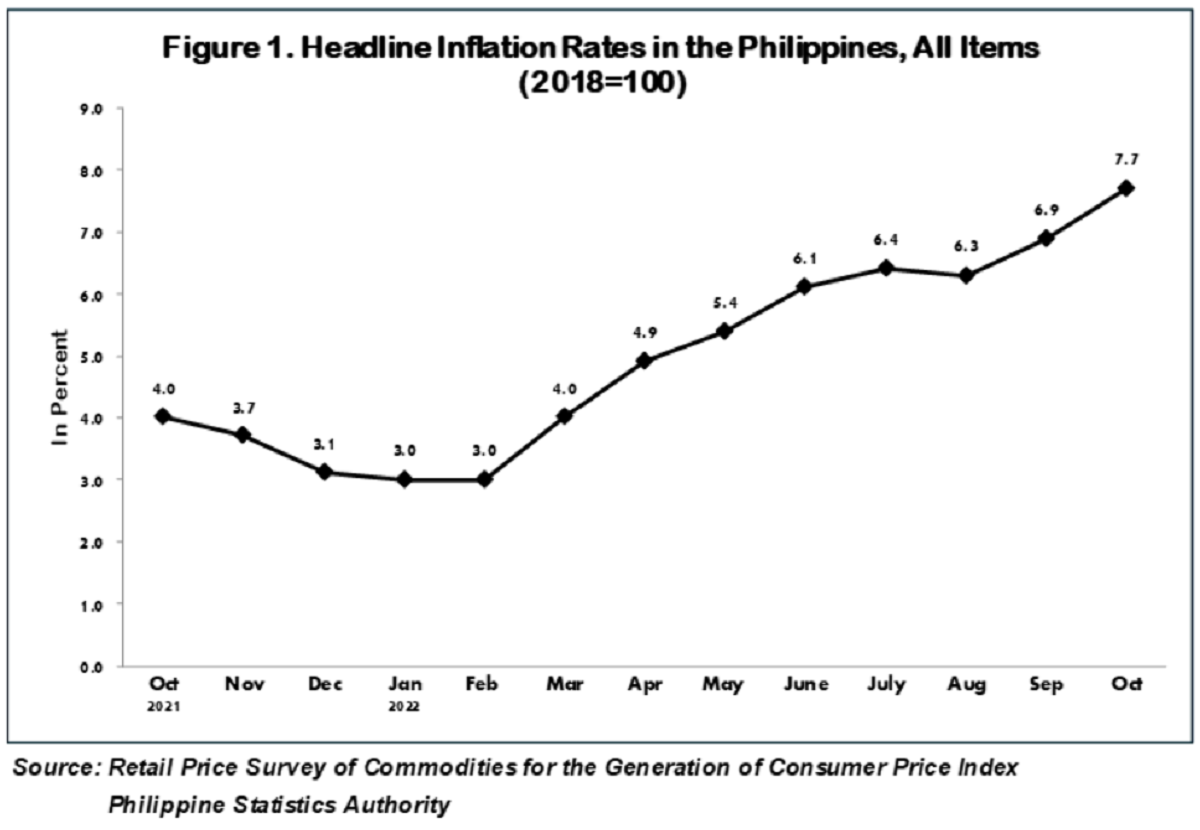

Last Friday, the Philippine Statistics Authority (PSA) released the Philippine October 2022 Inflation Report with a figure of 7.7%, higher than September 2022’s figure of 6.9%.

This figure is the highest inflation recorded since October 2008.

Still, you might be wondering, “What’s inflation and how can it affect me?”

Inflation is defined as the price increase of goods and services. It diminishes the purchasing power or value of your money over time.

In simpler terms, your Php500 a decade ago doesn’t buy the same items as today. Therefore, the same Php500 bill today is worth lesser now.

Ironically, even though there is a dramatic increase in the overall goods and services, we can see that almost all establishments, especially restaurants, are fully booked. Sales of luxury goods are at their all-time high.

This is most likely due to the two-year pandemic that held us captive in our homes and deprived us of spending and shopping.

Now, since lockdown restrictions are almost at a bare minimum, people are so eager to do “revenge spending and shopping.” In millennial terms, we’re enjoying YOLO (You Only Live Once).

Inflation Proof Items or Investments

Spending topic aside, here are some tips on inflation-proof items or investments:

1. Commodities like gold, oil, and precious metals

They don’t fluctuate much if ever there is a downturn in the economy.

Over a long period of time, since these commodities are considered rare and low in supply, they are usually a safe haven investment.

2. Inflation Staple Stocks and Funds

Inflation staple stocks or listed companies that usually produce basic food consumables such as biscuits, noodles, and snacks, are usually inflation-proof since they can easily pass on their cost to the consumers.

These companies are usually not affected by inflation or the rise in their raw material costs.

3. Investment in Selective Real Estate

Well, not all real estate investments produce inflation-beating returns.

But by strategically choosing which real estate to invest in and researching how much rental yield it generates, real estate is still one of the safest investments that one could have.

4. Luxury Goods and Collectibles

Ironically, some luxury goods, especially the niche and hard to get in the store, are extremely inflation-proof.

In fact, even if their prices increase, there is little effect on their sales since their customers (usually the elite and socialites) are not really affected by the price increases.

However, I suggest you do some research before investing in these fine things.

Brands like Hermes, Chanel, Rolex, Patek, and so on, have a proven and strong track record of their items not falling below their market values as their items are almost impossible to get – unless you get a premium from the gray market.

Any ideas where to park your cash and make them inflation-proof? Share your ideas in the comments below and let’s discuss!