The Social Security System (SSS) defines an employer as any person—natural or juridical; domestic or foreign—who carries on in the Philippines any services of another person who is under his or her orders as regards the employment, except those which are in the public sector.

Employers are compulsorily covered by the SSS and it starts on the first day of his or her operations.

As such, the following are also considered as ‘employers’

- A social, civic, professional, charitable, and other non-profit organization that hire the services of employees;

- A foreign government or international organization, or its instrumentalities, such as an embassy with an approved Administrative Agreements under the SSS for the coverage of its Filipino workers; and

- A household employer who uses the services of a house helper.

Non-reporting of employees and non-remittance of their contributions are a violation of the SSS Law. An employer who is in violation of such must pay the benefits of those employees who die, become disabled, get sick, or reach retirement age. In addition, he or she must pay all unpaid contributions plus a penalty of two percent per month for late payments. These are all on top of a criminal offense punishable by fine and/or imprisonment.

How to register as an employer?

Photo credit: SSS

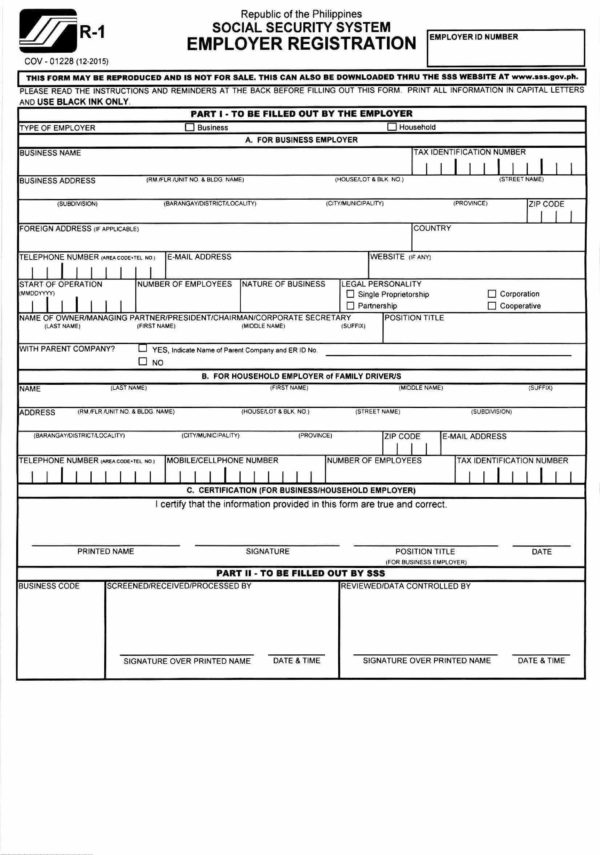

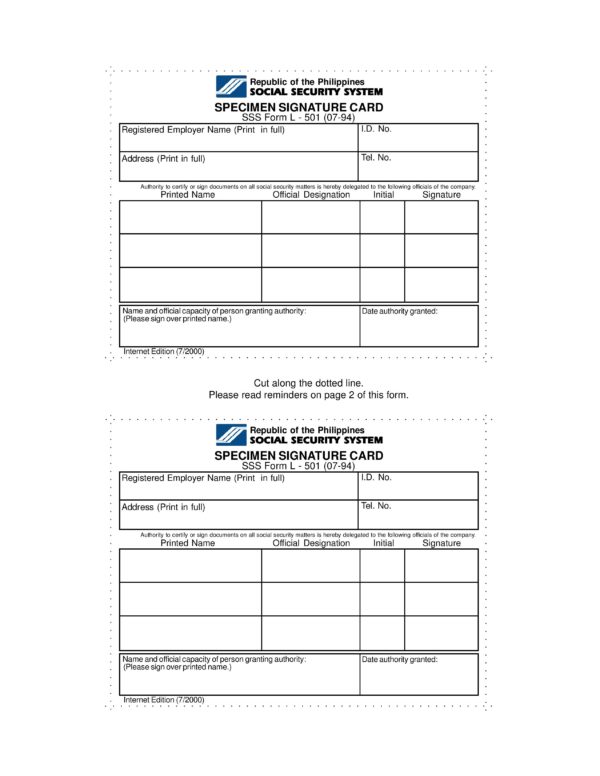

One must proceed to an SSS branch who has jurisdiction over the place where the business is operating, or residence, in the case of household employers. Once there, the employer must approach the Member Services Section to get and accomplish an Employer Registration Form (SS Form R-1), Employment Report Form (SS Form R-1A) and Specimen Signature Card (L-501).

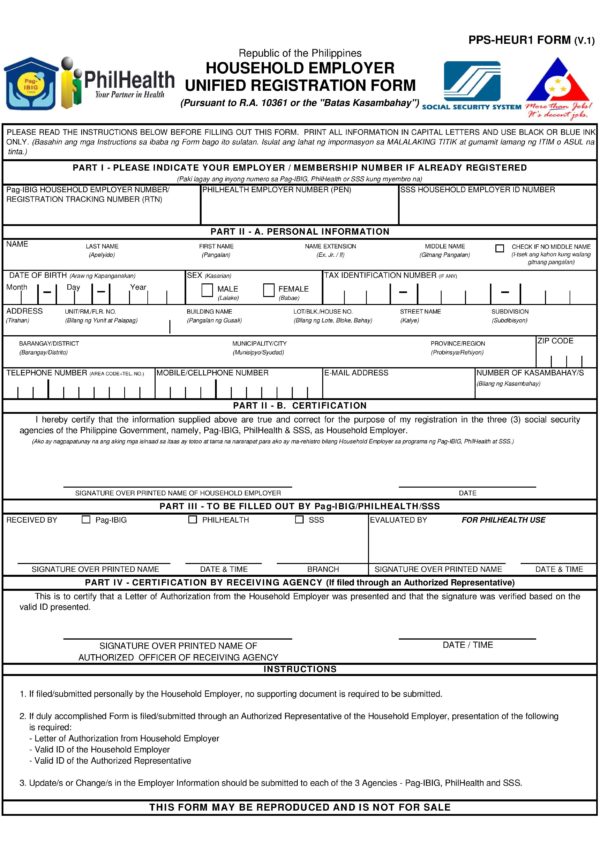

A household employer will have to fill up a Household Employer Unified Registration Form (PPS-HEUR1 Form).

Photo credit: SSS

These registration forms must be signed by the President, Chairman, or Corporate Secretary.

A foreign-owned corporation must also submit a copy of an approved Articles of Incorporation and License to Transact Business in the Philippines. The designated Philippine representative, as shown in the Securities and Exchange Commission (SEC) registration shall be the authorized signatory of the registration form.

For manning agencies with foreign principals, the authorized signatories are the President, Chairman, or Corporate Secretary. They must also submit an approved Articles of Incorporation and Agency Agreement between the manning agency and foreign principal.

Photo credit: SSS

An authorized representative may sign on behalf of a cooperative but must also submit a valid ID, together with the registration form and an approved Articles of Cooperation from the Cooperative Development Authority (CDA).

The SSS personnel will facilitate the registration of the employer. After the processing, the registering employer will receive processed copies of SS Form R-1/HEUR1 Form, SS Form R-1A, Specimen Signature Card, and Authorized Representative Card.

SSS registration is free of charge and will be completed within the day.

An individual who wishes to have an SSS number may do so online.

- Due to Unfair Practices, SEC Bars Lending Firm’s Operation - December 30, 2020

- Motorists Can Use Partially Open Skyway 3, Free for a Month - December 28, 2020

- Monthly Contributions to the SSS’s Mandatory Provident Fund Starts in January 2021 - December 26, 2020