The Bureau of Internal Revenue (BIR) has established an e-Registration system that offers convenient online internet access to taxpayer registration services such as online issuance of a taxpayer identification number, or TIN, for individual taxpayers.

The e-TIN is a module under the e-Registration system that enables single proprietors, professionals, mixed-income earners, and local employees to acquire a TIN. Those persons who need a TIN to apply for a government permit, license, clearance, official paper, or document may also obtain such through the e-TIN.

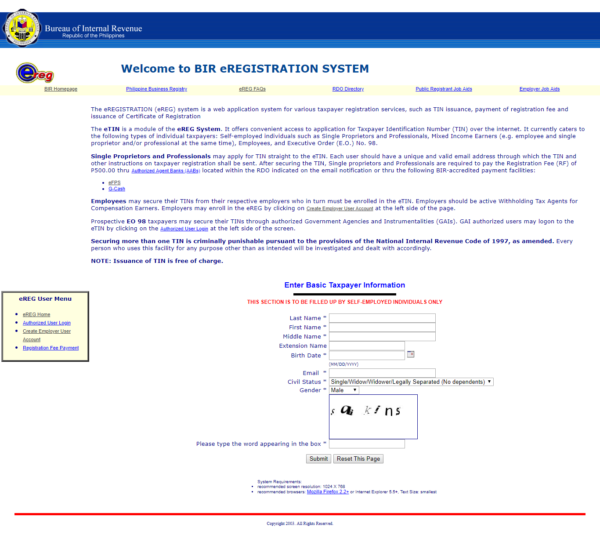

Photo credit: BIR

A TIN is especially required if one intends to establish a business in the country.

How To Apply For TIN Number Online

Single proprietors and professionals may apply for an e-TIN by going to ereg.bir.gov.ph. He or she must have a unique and valid email address, as this is where the TIN and other instructions on taxpayer’s registration will be sent.

Once they received their TINs, they should click the link to the BIR Form 1901 which can be found in the email notification from BIR. They should print out the form and the entire email message itself, which will serve as the Confirmation Page. Afterward, they should proceed to their assigned revenue district office (RDO) for the verification of taxpayer information.

Successful TIN registrant must pay a registration fee of P500 through authorized agent banks located within the RDO.

Once done, registrants must secure a copy of their Certificate of Registration (COR).

The next step for them is to secure a digitized TIN ID.

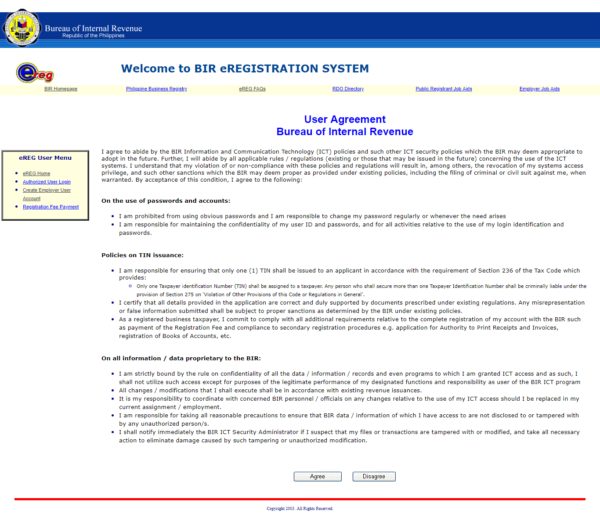

Photo credit: BIR

Employers may facilitate the enrollment of their employees in the e-TIN if they are already enrolled in the eREG. If not yet registered, they may create an employer user account. Employers may also request for the issuance of TIN cards of their employees in batches of 20 employees to their RDO.

Only one TIN

It is important to note that a person may just have one TIN. It is criminally punishable to have more than one. The Basic Taxpayer Data page ensures that all those who will register through e-TIN do not have an existing TIN.

If you think that you may already have a TIN, the BIR can recover it for you.

For more information about registering for a TIN, please visit ereg.bir.gov.ph.

- Due to Unfair Practices, SEC Bars Lending Firm’s Operation - December 30, 2020

- Motorists Can Use Partially Open Skyway 3, Free for a Month - December 28, 2020

- Monthly Contributions to the SSS’s Mandatory Provident Fund Starts in January 2021 - December 26, 2020