A lot of people think that investing involves a lot of money and that ‘ordinary’ people like them are not qualified because they don’t have millions of pesos to spare. The reality is that there are now plenty of options for investments for as low as Php50!

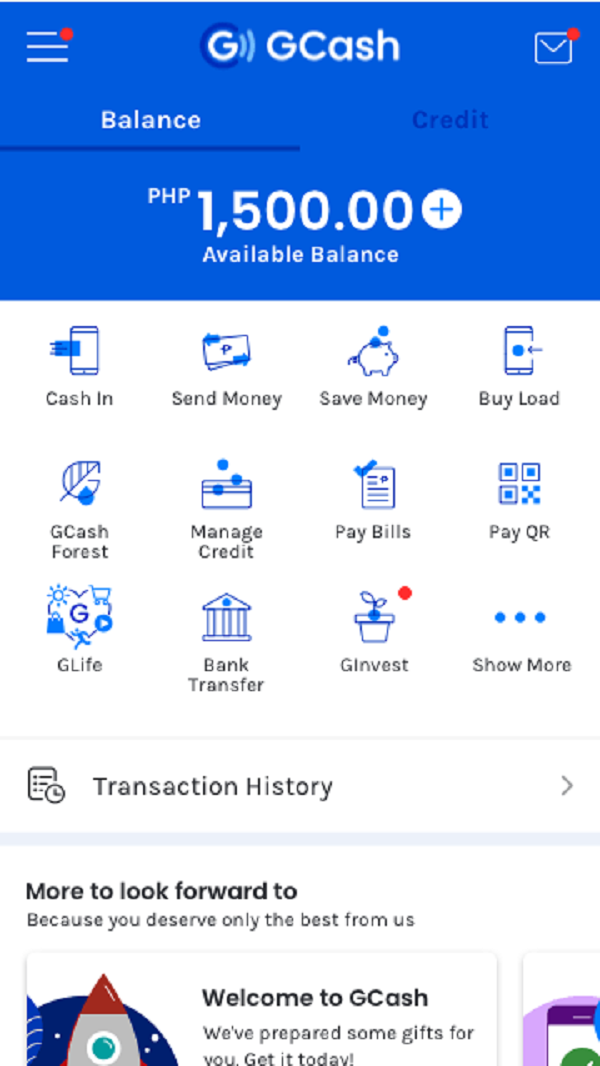

GCASH is Country’s Leading Mobile Wallet

There is no question that GCASH is the leading mobile wallet in the Philippines. Although it also has some strong competitors in this segment, it owns the biggest share of the market with over 33 million users at the end of 2020.

As the BSP (Bangko Sentral ng Pilipinas) aims to convert the Philippines into a coinless society by 2025 and double the number of adults with bank accounts by 2023, GCASH is predicted to continue as the market leader.

What’s great about GCASH these days is that it now offers a variety of other financial products. For example, through GCredit users are able to use the GCASH system in a similar manner as a credit card but without going through the strict processes that banks require their clients.

How to Invest on GInvest Using GCASH

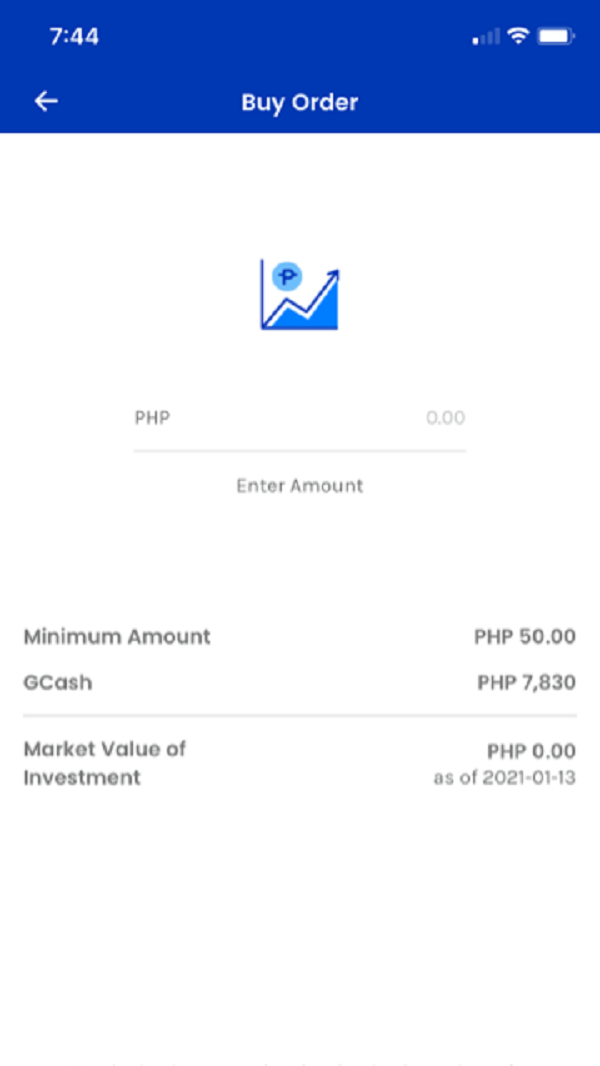

Recently, GCASH launched GInvest. While banks usually require at least Php10,000 for clients to open an investment, GCASH users can start growing their money for an amazingly low minimum of Php50! There are no commission or sales fees.

Moreover, GInvest only requires GCASH account verification for users to start investing. Plus, the cash-in and cash-out transactions are done through the GCASH wallet.

Follow these steps to start investing on GInvest:

Step 1. Open a GCASH account and get verified. Once you get the account verified, click “GInvest” using the GCASH app.

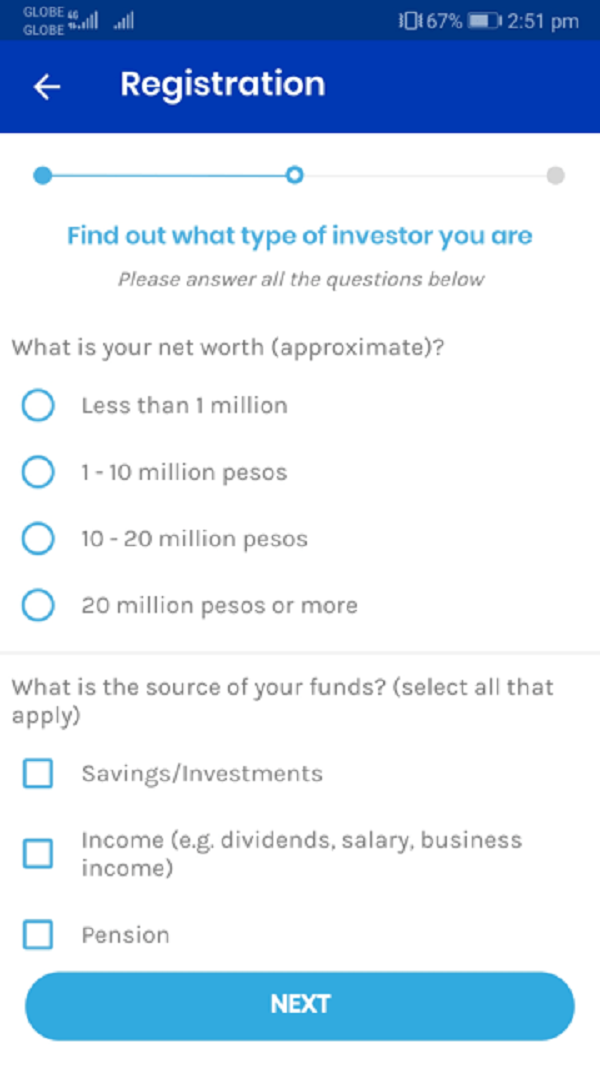

Step 2. Complete the Risk Profile Questionnaire to register your GInvest account. The app will determine what time of investor you are, ranking users as “conservative”, “moderate aggressive”, and “aggressive”.

The investment options available for each profile will be different, so will the interest rates and minimum investment. Obviously, aggressive investors are likely to earn more; though they are also the ones who stand to lose more if the investment fails.

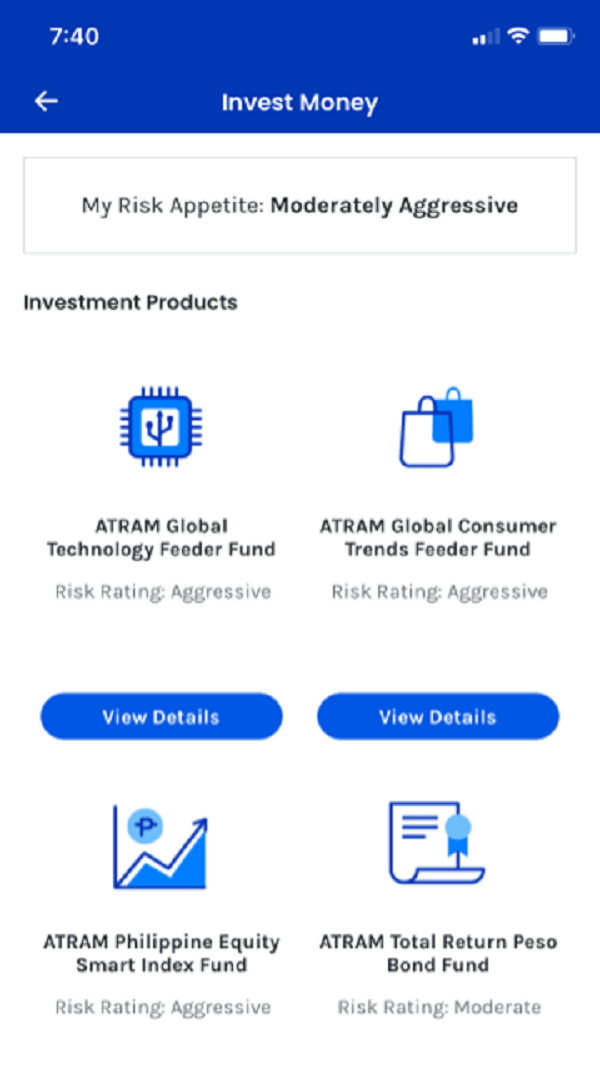

Step 3. Once your account is approved, you can see the investment options. Study the options and choose the investment fund that suits you best.

Step 4. Buy units from your chosen funds using your GCASH balance.

Step 5. Track your investments and watch your money grow. What’s great about GInvest is that there is actually no holding period. There are also no fees deducted from the investment if you decide to sell your units.

GInvest is a great option for those who wish to grow their money. Take note that just like all other investments, this does not how a 100% guarantee that you will earn a lot of money. As a general rule, make sure that you only invest money you can afford to lose.

- Viral Ice Seller ‘Miss Yelo’ Earns Php90k a Month - March 4, 2024

- Unique ‘Lechon Manok’ Cooked in a Clay Pot Goes Viral - February 29, 2024

- Carinderia in Tondo Goes Viral for Delicious Food, Inspiring Owners - February 17, 2024