In order to keep the business ‘sustainable’, e-commerce platform Shopee raises its transaction or handling fee from 1.5 percent to two percent, for every successful transaction.

However, the said increase is not, in any way, related to the proposed digital transaction tax.

“This move aims to create a healthy e-commerce ecosystem that sustainably benefits both buyers and sellers in the long run and facilitates seamless payment transactions,” Shopee said.

Image: Facebook/Shopee

The e-commerce platform added that its goal has always been to provide the best user experience.

“We want to build a sustainable business through strong local user engagement”, Shopee stated. Furthermore, the company said that it will continue updating its e-commerce platform with new features and offer attractive promotions and campaigns.

Seller transaction fee

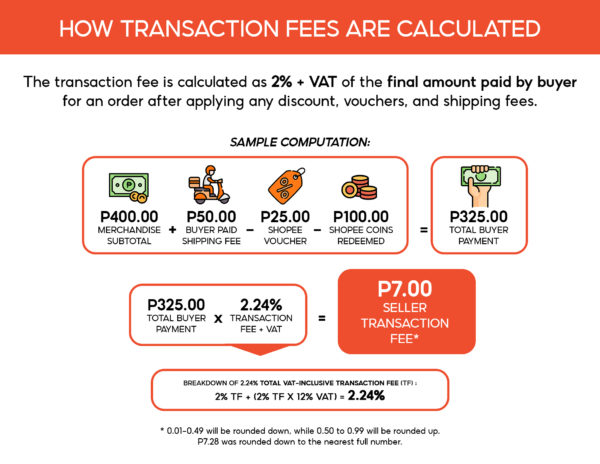

According to Shopee’s website, a seller transaction fee is a handling fee that covers the cost of the payment transactions fulfilled through Shopee’s payment services. It is charged on the overall value of the transaction, which is the value of what the buyer pays for—the cost of the merchandise and the shipping fee—and not the amount credited to the seller.

Starting this August, all successful transactions will be charged with a transaction fee, plus value-added tax (VAT).

Image: Shopee

Shopee also clarified that under local tax regulations, transaction fees are subject to VAT. The imposition of the tax is on the transaction fee charges, and not on the sellers’ merchandise.

The list of Shopee’s payment services includes ShopeePay, cash on delivery, credit or debit card, online banking, remittance or payment centers, over-the-counter, and bank transfer.

Last year, Shopee started charging a 1.5 percent transaction fee, without the VAT.

Department of Finance Secretary Carlos Dominguez III said that the government is looking into how to capture digital purchases into the VAT base and how to absorb profits generated by companies into the income tax system given their ‘transnational’ nature.

- Due to Unfair Practices, SEC Bars Lending Firm’s Operation - December 30, 2020

- Motorists Can Use Partially Open Skyway 3, Free for a Month - December 28, 2020

- Monthly Contributions to the SSS’s Mandatory Provident Fund Starts in January 2021 - December 26, 2020